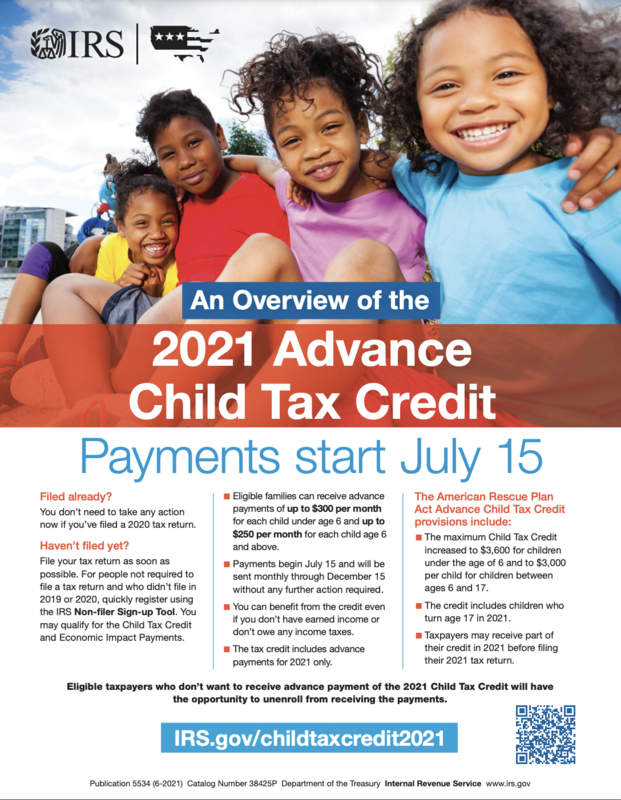

Information for Families on the Advance Child Tax Credit

The Internal Revenue Service needs the help of Connecticut school districts in publicizing IRS Advance Child Tax Credit payments. Advance Child Tax Credit payments, up to $250 per month per qualifying child ages 6 – 17 and up to $300 per month per qualifying child under age 6, started in July and will go through December 2021. Most taxpayers will receive these payments automatically. However qualifying families who did not file a 2019 or 2020 tax return must either file those returns or use the IRS non-filer sign up tool to receive Advance Child Tax Credit payments. Please see flyers (in English and Spanish) for more information.